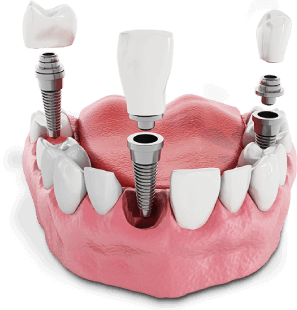

Making Dental Implants More Accessible

At FoX Implant Centre, we believe everyone deserves a long-lasting, confident smile. That’s why we offer a range of payment options to make dental implants more accessible.

We understand that dental implants require a more upfront investment than traditional dentures. But they are more cost-effective in the long run. With proper care, dental implants can last a lifetime, unlike dentures and bridges, which often need replacing. So, while the initial cost may be higher, you’ll save money over time, making dental implants a wise investment for your oral health.

We also work with patients to find solutions that suit their financial situation, offering tailored payment options to spread the cost over time. Whether through financing plans or superannuation access, we help you achieve a permanent smile without unnecessary financial stress.

How Much Do Dental Implants Cost in Australia?

The cost of dental implants in Australia can vary depending on several factors. While prices range widely, understanding what influences the cost can help you plan for your treatment.

Factors affecting dental implant costs:

- Type of implant: Single tooth, multiple implants, or full-mouth restorations

- Materials used: Titanium, zirconia or other prosthetic components

- Procedure complexity: Simple placements versus bone grafts or sinus lifts

- Location of the practice: Costs can differ by city or region

Typically, dental implants might cost between $3,000 and $70,000. This usually includes consultation, surgery, implant, abutment and crown.

The best way to get an accurate estimate of your dental implant cost is to book a consultation with our dentists. During your consultation, we will assess your oral health, discuss your treatment goals and provide you with a personalised quote.

What is a dental payment plan?

A dental payment plan lets you pay for treatment in manageable instalments rather than up front. We partner with trusted providers like TLC and Humm, offering:

- Interest-free options

- Flexible fortnightly or monthly payments

- Quick approvals (usually within 24–48 hours)

Benefits of a Payment Plan:

- Avoid large upfront costs

- Make dental care affordable sooner

- Maintain quality care without compromise

- Budget easily with predictable repayments

Financing Implants with Dental Loans

Dental loans are a type of personal loan specifically designed to cover dental expenses. They can be a helpful way to finance dental implant procedures, which can be costly. You can use it to cover the entire cost of your dental implant procedure or just a portion of it.

In Australia, dental loans typically work like any other personal loan. You borrow a certain amount of money from a lender and repay it over a set period, usually with interest. The amount you can borrow and the interest rate will vary depending on your financial situation and the lender you choose.

Lenders assess various factors before approving a dental loan, including your credit history, financial situation, and loan amount requested. Some loans come with fixed interest rates, while others offer variable rates. So, it’s essential to compare options to find the best fit for your needs. Many lenders also offer flexible terms, so repayments fit comfortably into your budget.

What is a dental loan?

Dental loans are personal loans for dental procedures. Options include:

- Personal Loans: Lump sum repayment over 1–7 years, fixed or variable rates

- Specialist Dental Loans: Tailored for dental treatments, fast approval, amounts up to $50,000

- Short-Term Loans: Smaller amounts for minor dental work, with faster access

Loan eligibility typically requires proof of income, Australian residency, a bank account and acceptable credit history. Interest rates, fees and repayment terms vary by provider.

Who Is Eligible for a Dental Loan?

Eligibility criteria for dental loans in Australia vary depending on the lender. However, some common requirements include:

- Credit History: Lenders will check your credit score and credit history to assess your creditworthiness. A good credit score increases the chances of loan approval, but some lenders may also offer options for those with bad credit.

- Citizenship or Residency: Most lenders require applicants to be an Australian citizen or a permanent resident.

- Bank Account: A valid bank account is required for loan disbursement and loan repayments.

- Income: You will typically need to provide proof of income to show you can afford the loan repayments.

Interest Rates and Fees

Understanding the interest rates and fees associated with dental loans is crucial to make informed financial decisions.

Interest rates can vary based on factors like your credit history, loan amount, and lender policies. Some loans come with fixed interest rates, providing predictable repayments, while others have variable rates that may fluctuate over time.

In addition to interest rates, lenders may charge other fees, including:

- Establishment Fee: A one-time fee charged at the beginning of the loan to cover administrative costs.

- Monthly Fee: A recurring fee that some lenders charge for maintaining the loan account.

- Late Payment Fees: Additional charges if repayments are missed or delayed.

- Early Repayment Fees: Some lenders may charge a fee if you pay off your loan earlier than the agreed term.

These fees can add to the overall cost of the loan, so it’s important to factor them in when comparing different options. Ask your lender about any applicable fees upfront to avoid surprises later.

How Much Can You Borrow for Dental Implants?

The loan amounts for dental implants vary depending on the lender and your financial situation. Some lenders offer loans as small as a few thousand dollars, while others may offer loans up to $50,000 or more.

Factors that can influence the loan amount include your credit history, income, and other financial obligations. Lenders will assess your ability to repay the loan and offer a loan amount that is appropriate for your situation.

How to Apply for Dental Loans in Australia

The loan application process for dental loans in Australia is generally straightforward. Many lenders offer an online application, allowing you to apply from the comfort of your home. Here’s how it typically works:

Compare Lenders

Research and compare different lenders to find the best interest rates, fees, and repayment terms.

Check Eligibility

Ensure you meet the lender’s credit assessment and other criteria before applying.

Gather Documentation

Prepare necessary documents such as proof of income, identification, and financial history.

Submit Your Application

Complete the online application or visit a lender’s branch to apply in person.

Loan Approval and Disbursement

If approved, the lender will transfer the funds to your bank account so you can proceed with your dental treatment.

Using Superannuation for dental treatment

Under Australia’s Compassionate Release of Superannuation, you may access your super to cover essential dental work, including implants.

We partner with accredited companies that can guide you through the application process, helping with the documentation and submission to the ATO. Early release can ease financial pressure for larger treatments and remove the need for monthly repayments.

Eligibility is determined by your superfund and the ATO, and not all dental treatments qualify.

Insurance & other payment options

Most private health insurance policies may cover part of dental treatment, but Medicare usually does not cover implants.

We also accept:

- Cash

- Checks

- Credit cards

These methods can be used alone or together with a payment plan, insurance or loan. Our team is here to help you understand your choices, making it easier to get the dental care you need when the time is right.

How to Get Started

Book a Consultation

We assess your oral health and create a personalised treatment plan.

Choose Your Payment Option

We explain all available plans and guide you to the best fit.

Submit Your Application

Most applications are quick and can be done in-clinic or online.

Begin Treatment

Start your dental implants without delay once your plan is approved.

How FoX Implant Centre makes implants more accessible

We’ve designed every part of our service to make the cost of your treatment easier to manage.

Here’s how we make dental implants more accessible for Australians:

- All-in-one care: Consultation, surgery and prosthesis crafted in-house

- On-site general anaesthesia: Avoids extra hospital fees or delays

- Transparent pricing: Know costs upfront with no hidden fees

- Flexible payment options: Interest-free plans, dental loans, or superannuation access

- Ongoing care included: Check-ups and maintenance built into your plan

Start your journey today

Getting dental implants doesn’t have to mean financial stress. At FoX Implant Centre, we offer a full suite of payment and financing options so you can start when you’re ready.

Every patient’s financial situation is different, which is why we’re here to help you find the right fit.

Book a free consultation with our experienced dental professionals today. We’ll assess your dental needs, explain your treatment plan and recommend the best payment option for your circumstances.

Disclaimer: This content is for general informational purposes only and is not financial or tax advice.

Eligibility for superannuation release and loans is determined by providers and the ATO. Individual dental needs vary; a consultation is required to determine the appropriate treatment plan.

FAQ

It’s very common! Many patients use payment plans alongside health fund rebates or early release of superannuation, where eligible. Combining options can make larger or multi-stage treatments more manageable. Before proceeding, it’s best to discuss your full financial situation with your dental team to ensure all arrangements are suitable for your circumstances.

Dental implant loans are personal or specialist loans that cover part or all of your treatment. Before applying, consider interest rates, repayment terms, fees and your capacity to make consistent payments. Comparing lenders and reading the fine print ensures the loan aligns with your financial goals without creating unexpected obligations.

Coverage varies between policies. Some private health insurance plans may offer partial rebates for certain stages of the implant procedure, while Medicare generally does not cover routine implants. You should always review your specific policy to understand what is included, any waiting periods and annual limits before relying on insurance for funding.

New Teeth in One Day

Funded by your Super

Request A Free Consultation

Get implant pricing and financing options,

Including your superfund!

Find Out If You're A Candidate!