Making Dental Implants More Accessible

At FoX Implant Centre, we believe everyone deserves a long-lasting, confident smile. That’s why we offer a range of payment options to make dental implants more accessible.

We understand that dental implants require a more upfront investment than traditional dentures. But they are more cost-effective in the long run. With proper care, dental implants can last a lifetime, unlike dentures and bridges, which often need replacing. So, while the initial cost may be higher, you’ll save money over time, making dental implants a wise investment for your oral health.

We also work with patients to find solutions that suit their financial situation, offering tailored payment options to spread the cost over time. Whether through financing plans or superannuation access, we help you achieve a permanent smile without unnecessary financial stress.

How Much Do Dental Implants Cost in Australia?

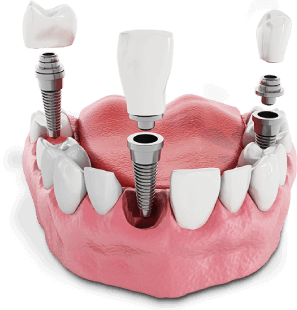

The cost of dental implants in Australia varies depending on several factors. These include the type of implant, the materials used, the complexity of the procedure, and the location of the practice. The cost can also increase if you need additional procedures like bone grafting or sinus lifts.

While the cost of dental implants can vary, you can generally expect to pay anywhere between $3,000 and $70,000. This price usually includes the consultation, surgery, implant, abutment, and crown. It’s important to note that this is just a ballpark estimate, and the actual cost of your dental implants may vary.

The best way to get an accurate estimate of your dental implant cost is to book a consultation with our dentists. During your consultation, we will assess your oral health, discuss your treatment goals, and provide you with a personalised quote.

Paying for Your Dental Implants at FoX Implant Centre

We understand that investing in dental implants is a big decision, and we aim to make the process as stress-free as possible. That’s why we offer a range of payment options to suit different budgets.

At FoX Implant Centre, we accept cash, checks, and credit cards for added convenience. For those looking for flexible payment solutions, we also provide various financing options like TLC and Humm. Plus, we can guide you through accessing superannuation funds if eligible.

Our financing plans allow you to spread the cost of your dental implants over time, making it easier to manage without the financial burden of a large upfront payment.

Our team will work with you to choose the best payment option for your needs. We will guide you through every step of the process to make sure you understand the process and feel comfortable with your decision.

Financing Implants with Dental Loans

Dental loans are a type of personal loan specifically designed to cover dental expenses. They can be a helpful way to finance dental implant procedures, which can be costly. You can use it to cover the entire cost of your dental implant procedure or just a portion of it.

In Australia, dental loans typically work like any other personal loan. You borrow a certain amount of money from a lender and repay it over a set period, usually with interest. The amount you can borrow and the interest rate will vary depending on your financial situation and the lender you choose.

Lenders assess various factors before approving a dental loan, including your credit history, financial situation, and loan amount requested. Some loans come with fixed interest rates, while others offer variable rates. So, it’s essential to compare options to find the best fit for your needs. Many lenders also offer flexible terms, so repayments fit comfortably into your budget.

What Kind of Dental Loans Can You Get in Australia?

You have several options when financing dental implants in Australia. These include:

Personal Loans: A common option for financing dental procedures, personal loans can be either secured or unsecured personal loans. These loans provide a lump sum that can be used for dental treatments such as fillings, root canals, and implants. Repayment terms typically range from one to seven years, with fixed or variable interest rates.

Dental Payment Plans: These plans allow you to pay for your treatment in instalments, often without interest. At FoX Implant Centre, we offer Humm, which allows you to spread your dental expenses into manageable, interest-free instalments.

Specialist Dental Loans: Some lenders offer loans specifically designed for dental procedures. These loans may have features tailored to dental patients, such as lower interest rates or more flexible repayment options. Total Lifestyle Credit, our partner at FoX Implant Centre, offers dental loans ranging from $2,001 to $50,000 with a hassle-free application process and fast approval.

Short-Term Loans: If you need a smaller loan amount for minor dental work, short-term loans provide quick access to funds. These loans often have higher interest rates but can be a useful option for those who need immediate dental care without waiting for long approval processes.

Who Is Eligible for a Dental Loan?

Eligibility criteria for dental loans in Australia vary depending on the lender. However, some common requirements include:

- Credit History: Lenders will check your credit score and credit history to assess your creditworthiness. A good credit score increases the chances of loan approval, but some lenders may also offer options for those with bad credit.

- Citizenship or Residency: Most lenders require applicants to be an Australian citizen or a permanent resident.

- Bank Account: A valid bank account is required for loan disbursement and loan repayments.

- Income: You will typically need to provide proof of income to show you can afford the loan repayments.

Interest Rates and Fees

Understanding the interest rates and fees associated with dental loans is crucial to make informed financial decisions.

Interest rates can vary based on factors like your credit history, loan amount, and lender policies. Some loans come with fixed interest rates, providing predictable repayments, while others have variable rates that may fluctuate over time.

In addition to interest rates, lenders may charge other fees, including:

- Establishment Fee: A one-time fee charged at the beginning of the loan to cover administrative costs.

- Monthly Fee: A recurring fee that some lenders charge for maintaining the loan account.

- Late Payment Fees: Additional charges if repayments are missed or delayed.

- Early Repayment Fees: Some lenders may charge a fee if you pay off your loan earlier than the agreed term.

These fees can add to the overall cost of the loan, so it’s important to factor them in when comparing different options. Ask your lender about any applicable fees upfront to avoid surprises later.

How Much Can You Borrow for Dental Implants?

The loan amounts for dental implants vary depending on the lender and your financial situation. Some lenders offer loans as small as a few thousand dollars, while others may offer loans up to $50,000 or more.

Factors that can influence the loan amount include your credit history, income, and other financial obligations. Lenders will assess your ability to repay the loan and offer a loan amount that is appropriate for your situation.

How to Apply for Dental Loans in Australia

The loan application process for dental loans in Australia is generally straightforward. Many lenders offer an online application, allowing you to apply from the comfort of your home. Here’s how it typically works:

Compare Lenders

Research and compare different lenders to find the best interest rates, fees, and repayment terms.

Check Eligibility

Ensure you meet the lender’s credit assessment and other criteria before applying.

Gather Documentation

Prepare necessary documents such as proof of income, identification, and financial history.

Submit Your Application

Complete the online application or visit a lender’s branch to apply in person.

Loan Approval and Disbursement

If approved, the lender will transfer the funds to your bank account so you can proceed with your dental treatment.

Paying for Implants Using Your Superannuation Fund

If you’re struggling to cover the cost of dental work, you may be able to access your superannuation fund to pay for your implants. Under the Australian Government’s Compassionate Release of Superannuation program, you can apply to withdraw funds early to cover essential medical treatments, including dental implants.

To apply for the CRS scheme, you must meet certain eligibility criteria, such as experiencing severe financial hardship or compassionate grounds. You will also need to provide supporting documentation, including a letter from your dentist stating the urgency of the treatment and relevant medical reports.

At FoX Implant Centre, we assist eligible patients in navigating the application process. We partner with SuperCare, an industry leader in accessing superannuation for medical expenses, to streamline the application and approval process for our patients.

If you’re considering using your superannuation to pay for dental implants, we encourage you to contact us to discuss your eligibility and options. Our team can answer your questions and guide you through the process to make sure you clearly understand your choices.

Insurance Coverage for Dental Implants

Insurance coverage for dental implants in Australia varies depending on the type of insurance you have.

Medicare, Australia’s public health insurance scheme, generally does not cover dental treatment, including dental implants. However, there are some exceptions, such as if the dental implants are required due to a medical condition or as part of a hospital stay.

Some private health insurance policies may cover a percentage of the cost, including dental surgery, check-ups, orthodontic treatments, veneers, and teeth whitening. Policies differ across providers, so it’s important to check your plan’s inclusions to determine if implants are covered.

At FoX Implant Centre, we help patients understand their insurance options and provide assistance in processing claims where applicable.

Choosing the Best Dental Financing Option for Your Needs

Choosing the best dental financing option can seem daunting, but it doesn’t have to be. Here’s a quick guide to help you navigate the different options and find the one that best suits your needs:

Consider your budget

Determine how much you can comfortably afford for monthly repayments. This will help you narrow your options and choose a loan term that aligns with your financial goals.

Understand the interest rates and fees

Different lenders offer different comparison rates, so it’s important to compare them carefully. Look beyond the headline interest rate and consider the establishment fee, monthly fee, and other charges that may apply.

Think about the loan term

The loan term affects the amount you repay in loan repayments each month and the total interest you pay over the life of the loan. A shorter loan term means higher monthly repayments but lower total interest, while a longer loan term means lower monthly repayments but higher total interest.

Choose a repayment schedule that suits you

Most lenders offer flexible repayment options, including weekly, fortnightly, and monthly repayments. Choose a schedule that aligns with your pay cycle and makes it easier for you to manage your finances.

Check the lender’s Australian Credit Licence

Before signing up for a loan, ensure the lender has an Australian Credit Licence. This shows they are authorised to provide credit in Australia and are subject to responsible lending regulations.

Don’t Let Cost Hold You Back from the Perfect Smile

You deserve a smile that makes you feel confident and healthy. So don’t let cost be a barrier to achieving your perfect smile. At FoX Implant Centre, we make it easy to get the dental care you need without the financial stress.

We are the only dental practice in Australia offering in-house end-to-end dental care, from consultation to surgery to crafting your new teeth. We even provide general anaesthesia in-house. Our comprehensive approach helps keep costs low and financing options more straightforward, as you don’t need to go to different places for different procedures.

Our team of dental professionals will work with you every step of the way to ensure you get the best dental care. We will discuss your needs and help you choose the financing option that best fits your budget.

Book a consultation with us today to explore your financing options and start your journey towards a healthier, more confident smile. Your oral health and overall well-being are worth investing in. Let us help you achieve the smile of your dreams.

[Disclaimer: We do not & cannot provide financial advice. The information provided is not (& cannot) be deemed as financial or tax advice as we are not financial or tax advisors. Always seek professional advice before making any financial decisions.

Not all dental treatments and conditions are suitable for Compassionate Release of Super. Our dental team will diagnose your specific ailment and let you know if you are eligible under the legislative criteria to apply for the use of your super to fund your dental treatment.

The ATO and your superfund will decide to approve or decline your application. Everyone’s dental health situation is different, therefore requiring a personalised treatment plan. Please book an appointment with our dentist to find out exactly what type of dental treatment is best for your particular situation.]

New Teeth in One Day

Funded by your Super

Request A Free Consultation

Get implant pricing and financing options,

Including your superfund!

Find Out If You're A Candidate!